Wyoming can build a stronger economy, and avoid more expensive solutions in the future, by thoughtfully expanding its tax base so that more of us pitch in.

SOLUTIONS

Studying states similar to ours can help Wyoming design its own path forward

There are as many state budget models as there are states, and there is no perfect formula. But most have a wider menu of taxes, higher taxes, and/or a longer list of taxpayers than we do.

For example, among the states that have no personal or corporate income tax (Nevada, South Dakota, Texas, Washington, and Wyoming), Wyoming has the second-lowest effective property tax rate. Texas and Washington have a corporate gross receipts tax.

West Virginia and Louisiana, ranked lower than or equal to Wyoming for property tax rates, assess personal and corporate income taxes ranging from 5.5 to 6.5 percent.

RECENT IMPROVEMENTS

Change is possible! In the last few years, the Wyoming Legislature has:

- Modestly increased fees for driver’s licenses and registrations, state parks, brand inspections, hunting permits and other items

- Taxed online retail sales at the same state rate as in Wyoming brick-and-mortar stores

- Ended a tax exemption on railroad rolling stock

- Enacted a moderate statewide lodging tax

NEXT STEPS

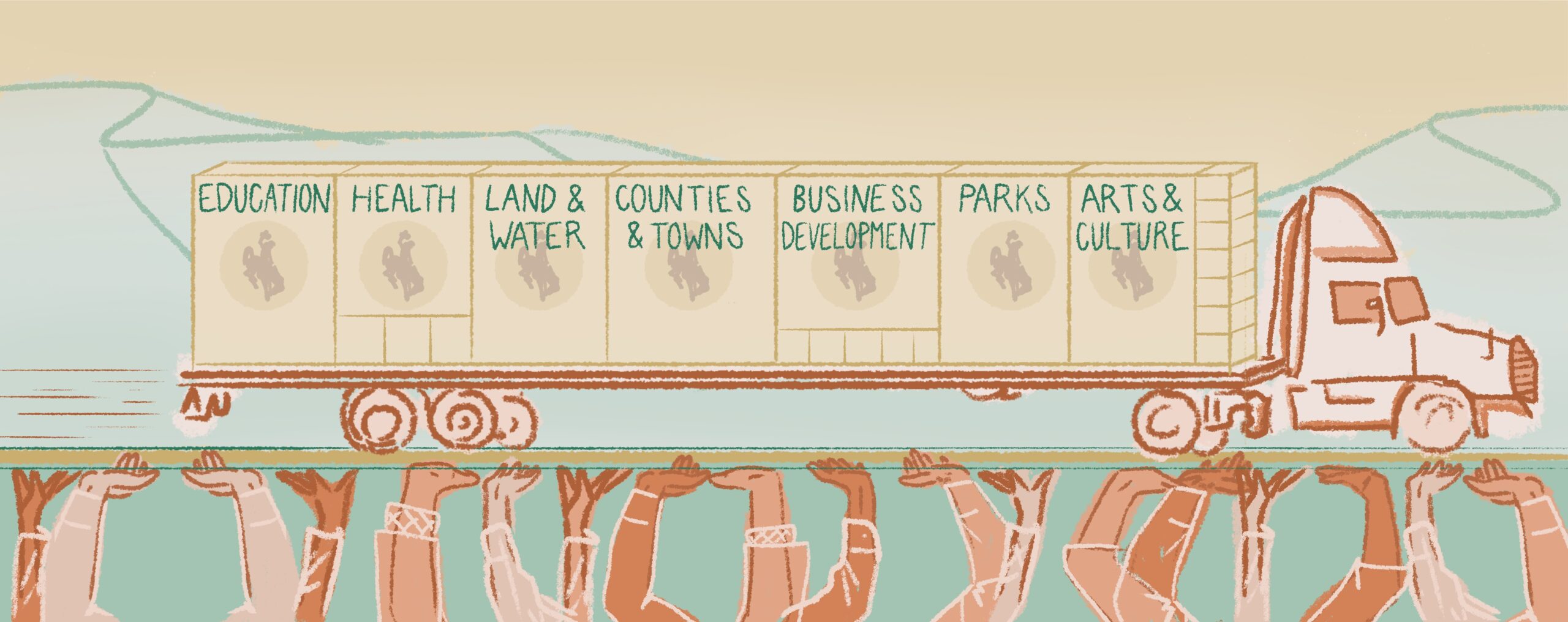

We can work with a host of flexible options to create the diversified tax base that fits us and preserves our unique quality of life.

An important study by Laramie County Community College has shown that most Wyomingites could afford incremental changes that would contribute significantly to maintaining our communities and services, while keeping Wyoming among the lowest-tax states in the nation.

Revenue measures being studied by the Wyoming Legislature include:

- Fewer tax exemptions for non-mineral industries

- Ending the sales tax exemption on most services

- Creating a tax on the sale of extremely high-value real estate

- Small increases in sales, fuel, and alcoholic beverage taxes

- Reasonable tolling on I-80.

- A tax on digital streaming services, and more

WHAT YOU CAN DO

We all have a role to play in deciding how Wyoming’s money is spent

Elected members of the State Legislature are regular Wyoming citizens, not full-time politicians. When working on the state budget, they listen to voters, county and city officials, state and local agencies, and interest groups to understand what Wyoming people want and need.

Talk to your State Representative and Senator in the Wyoming Legislature about where our tax revenues come from and what they support in your community. Learn about the Legislature and find your Representative and Senator here.

- Share this website and our partners’ websites with your friends.

- Visit our Q&A page for a deeper dive

- Check out our Resources page for links to reliable data.

- Your mayor, town council, and county commissioners have first-hand knowledge about how state and local tax revenues impact your community. Talk to them!