Our budget

What does

our state

budget do?

State budgets, and the taxes that support them, are a system of forward exchange – we pay taxes forward, not for immediate goods and services, but so we have them available in the future. We have public goods and services now (schools, libraries, parks, roads, emergency services, law enforcement) because of taxes paid in the past.

Unlike a household budget, with its small scale and short-term planning cycle, the state budget must include the needs of Wyoming’s entire population now, and decades into the future.

Every year, the Governor and Legislature review the budget and consider Wyoming residents’ shared priorities, looking for the best ways to sustainably address our needs and opportunities.

Failure to support needed services with our tax dollars now would mean higher costs and lower quality of life down the road. It is our responsibility to provide for future generations.

State services touch us all

Government employees are our neighbors, customers, volunteers, and family members. Their work helps sustain every facet of our Wyoming quality of life.

WhEN does Wyoming have trouble covering its costs?

Wyoming has a history of cyclical budget deficits because our state revenue is closely tied to the booms and busts of oil, natural gas, and coal. This makes our state’s income hard to predict. For a handy description of Wyoming’s revenue sources, see pages 9-12 of the State’s 2023 Budget Fiscal Data Book.

Our State Constitution (Article 16, Sections 1 and 2) and Wyoming Statute 9-2-1013 require the Governor and Legislature to enact a balanced state budget. If revenues (taxes and other state income) do not keep up with expenses (costs of state services), state leaders can balance the budget by cutting services, spending reserves, raising taxes, or a combination of the three.

In the 1970s, Wyoming began to heavily tax its mineral industries while reducing taxes on individuals and businesses. Since then, shortfalls during industry “busts” have been resolved by cutting state and local services and spending reserves. Until recently, each bust eventually ended with a rebound in the mineral industry, delaying the need to find new sources of tax revenue.

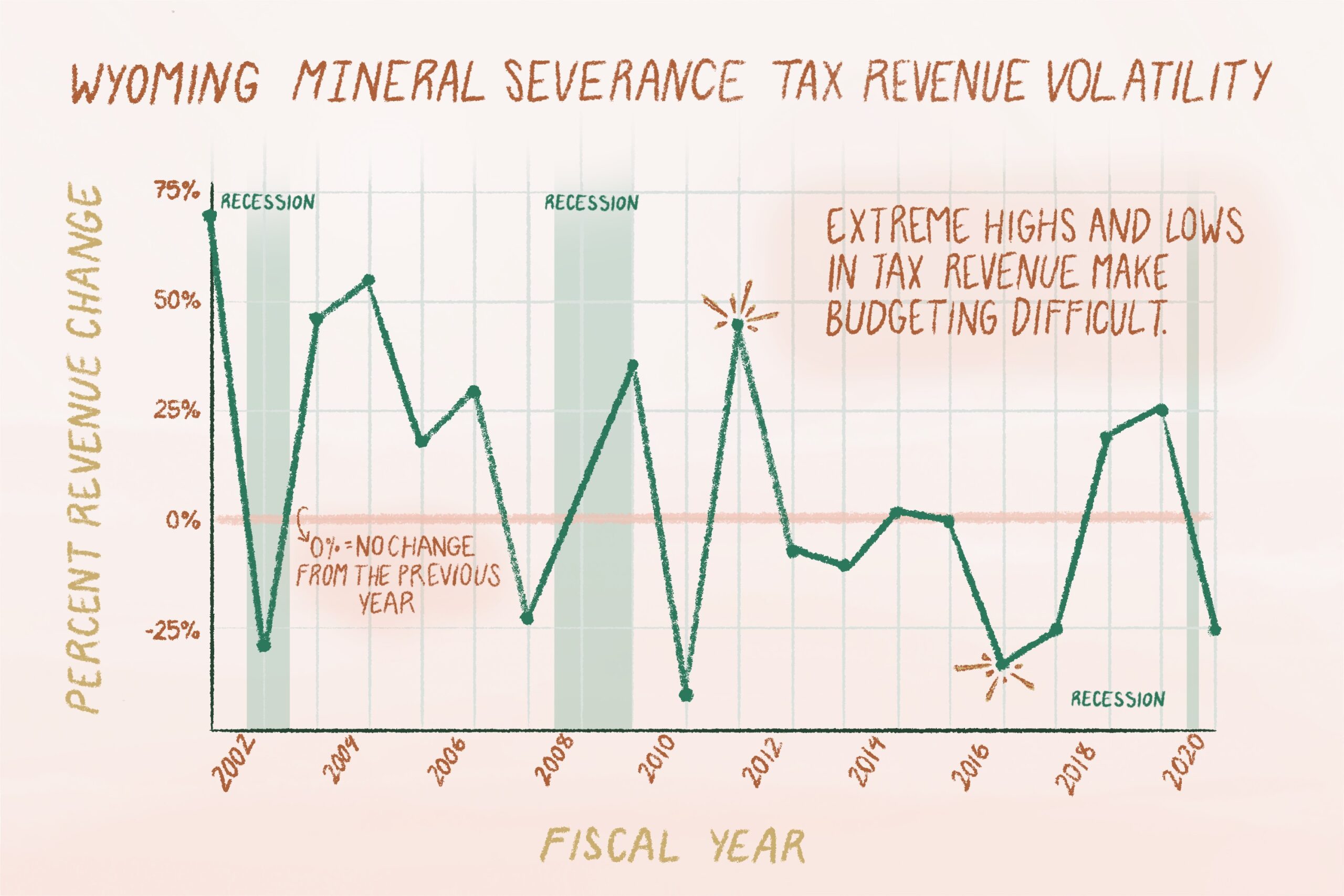

This graphic shows the ups and downs, from year to year, of mineral severance tax revenue. Severance income meets the 0% line when it is the same as the year before. Wyoming’s “volatility score” comes in at 3rd in the nation, behind Alaska and North Dakota. The Wyoming Governor and Legislature must create the state’s budget despite this unpredictability.

Data for chart from Pew Charitable Trust, “Fiscal 50: State Trends and Analysis,” updated Dec. 7, 2023. Infographic by Eda Uzunlar

This time is different

Wyomingites have weathered many ups and downs in oil and natural gas markets. High demand for coal, which has sold at relatively stable prices for many years, has made Wyoming’s K12 education system among the best in the nation. But with lower demand from customers worldwide, and some coal-fired power plants scheduled for closure, we are seeing a decline in the market over the long term.

Continuing volatility in oil and gas prices, together with lower coal production, means that our traditional tax revenues from the minerals industry will become less reliable, and less able to cover expenses.

Because costs of necessary goods and services will always rise, continually cutting the budget and spending reserves are not long-term solutions.